The latest SpendTrend24 report, a collaborative effort between Discovery Bank and Visa, sheds light on the spending behaviours of consumers, highlighting South Africa’s robustness compared to its global peers.

- South Africans are increasingly using their mobile phones to pay instead of physical wallets, with adoption rates matching or surpassing those of international cities.

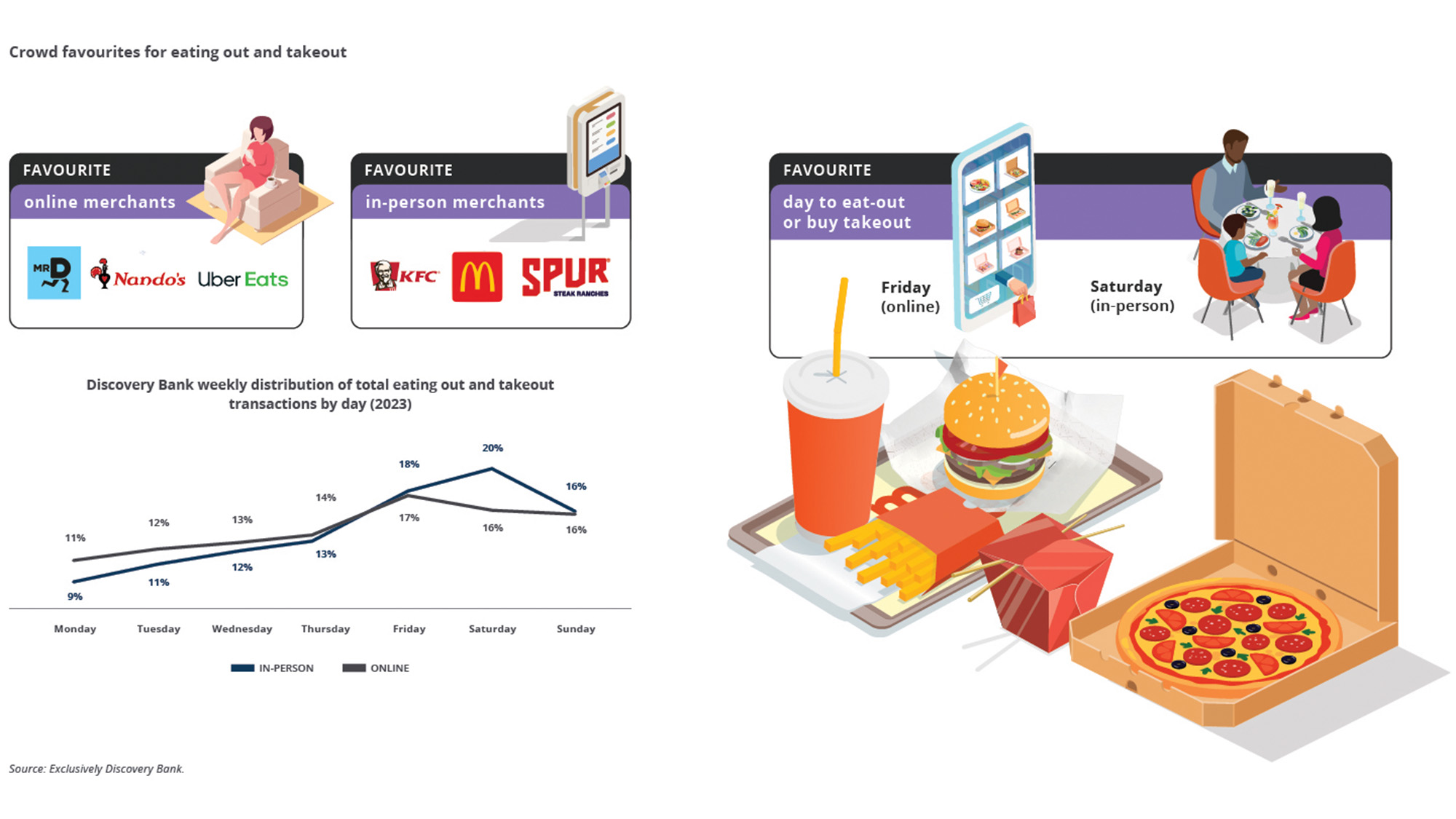

- Spending on eating out and takeout also increased in the last year by 8%, following a 28% surge the year before, driven by post-pandemic recovery.

- South Africans are increasingly shopping online, surpassing other emerging market cities and keeping pace with developed ones.

- Visit www.sandtontimes.co.za for more stories.

The economic landscape has been nothing short of tumultuous globally, yet amidst these challenges, South Africa has showcased remarkable resilience in consumer spending, propelled by a surge in digital wallet adoption.

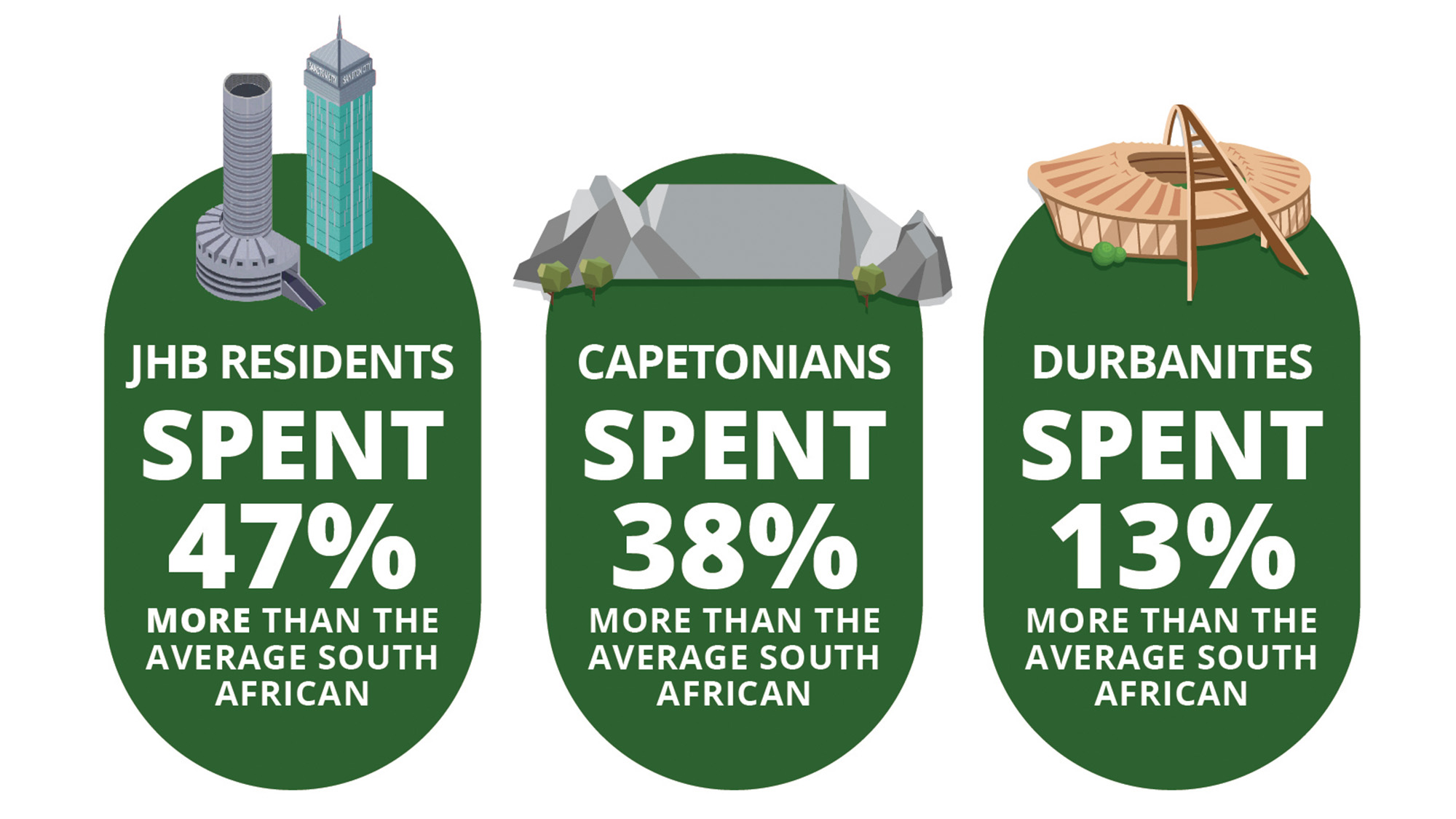

Based on an analysis of over 13-billion transactions across 14 cities worldwide, including Cape Town, Durban, and Johannesburg, the report provides comprehensive insights into consumer trends from 2019 to 2023. These insights not only underscore the evolving consumer preferences but also underscore the role of digital transformation in reshaping spending patterns.

Key Insights from SpendTrend24:

1. Resilient Spending Amid Economic Turbulence

While global economies grappled with rising inflation and interest rates, South Africa emerged as a beacon of resilience. Despite facing a challenging macro-economic environment, South African cities exhibited stable year-on-year spending patterns, showcasing resilience compared to many global counterparts. The growth in consumer expenditure in South Africa in 2023, while lagging inflation by two percentage points, underscored the adaptability of consumers in navigating financial pressures.

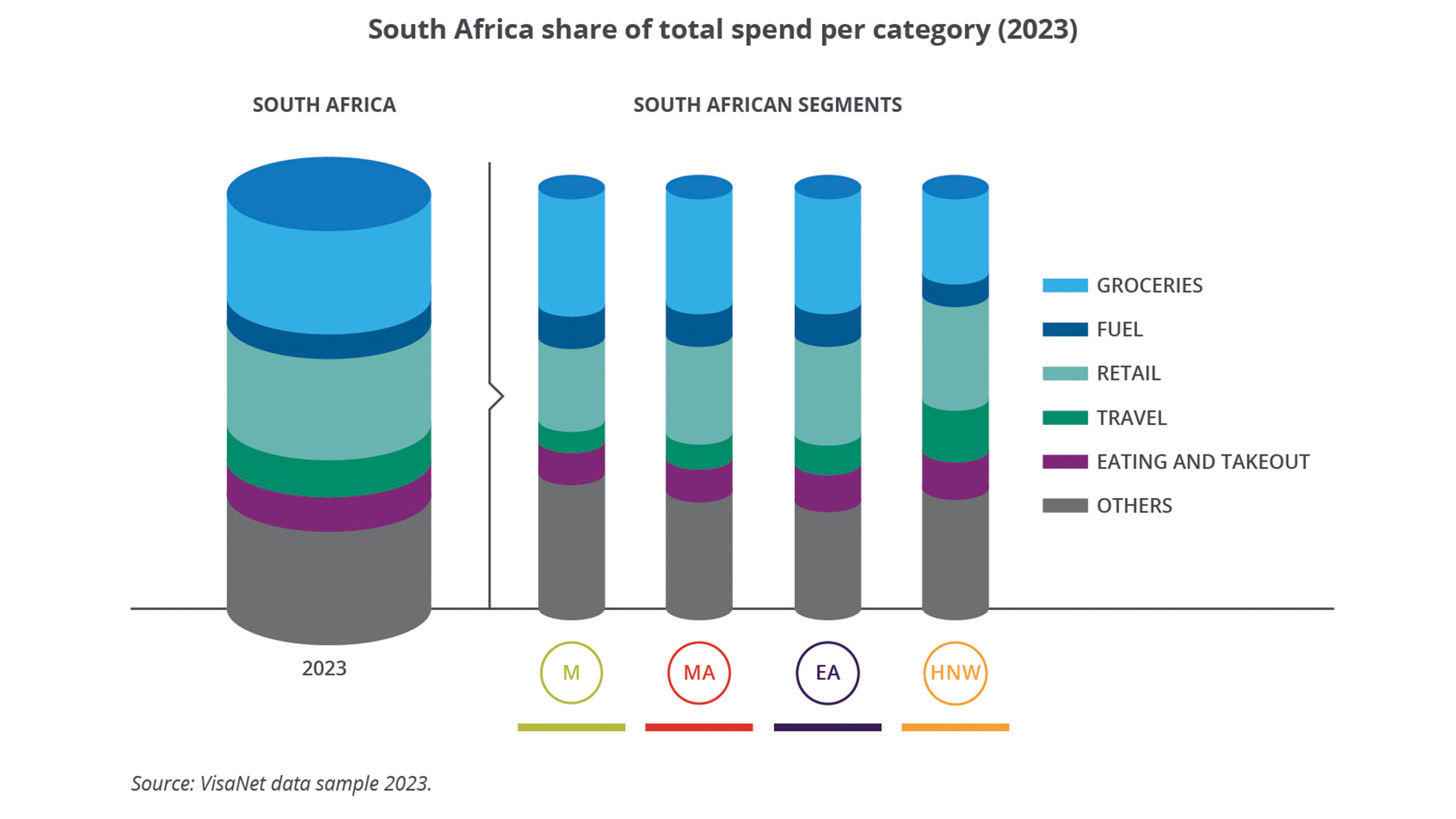

2. Dominant Spending Categories

Groceries, retail, travel, and fuel emerged as the primary expenditure categories for South African consumers, collectively constituting nearly two-thirds of spending. Notably, emerging market cities allocated a higher share of their budget to essentials like groceries and fuel, reflecting a prioritization of necessities amidst economic uncertainties.

3. Shifts in Consumer Behavior

Consumer spending trends witnessed variances across market segments, with affluent and high net worth segments experiencing growth, while the mass segment exhibited modest growth or declines. Choices were often dictated by a balance between affordability and convenience, with segments and markets diverging in their spending patterns on essentials versus non-essentials.

4. Surge in Digital Wallet Adoption

A notable highlight of the report was the rapid adoption of digital payment options globally, with South Africa outpacing its counterparts in digital wallet usage. With a remarkable nine-percentage-point increase in digital wallet usage over the last year, South Africa showcased a strong embrace of digital transformation in financial transactions, reflecting increased security and convenience.

Insights into Spending Habits:

1. Spending Trends

Personal consumer spending growth in South Africa stabilized in 2023 following the post-pandemic surge observed in 2022. While consumer spending outpaced inflation by 19 percentage points in 2022, growth aligned closely with inflation in 2023. Groceries witnessed increased spending, driven by high food inflation rates, while spending on eating out and takeout also surged, indicating a gradual recovery in post-pandemic consumer behaviour.

2. Travel Dynamics

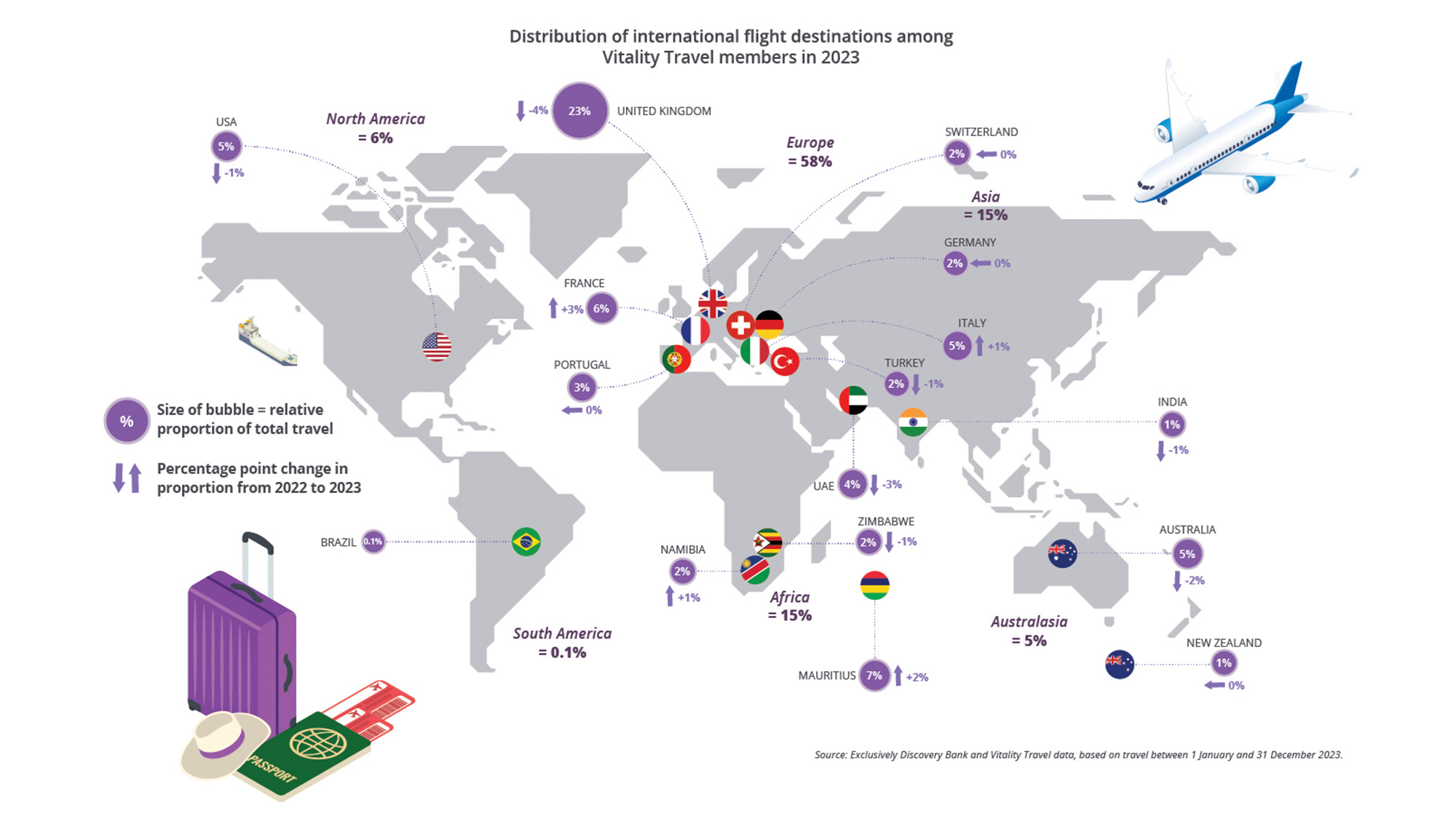

After experiencing a surge in ‘revenge-travel’ post-pandemic, South African travel habits stabilized in 2023, albeit at higher costs. The report highlighted the inflationary pressures impacting global travel volumes, signalling a recovery in the travel industry tempered by increased costs.

3. Payment Preferences

South Africans showcased a notable shift towards digital payments, with mobile phone usage surpassing physical wallets. Online spend in South Africa outpaced in-store growth by five times, reflecting a growing preference for digital transactions and e-commerce platforms.

In the face of global economic uncertainties, South Africa’s resilience in consumer spending underscores its adaptability and the growing embrace of digital transformation. The insights gleaned from SpendTrend24 not only offer a nuanced understanding of consumer behaviour but also pave the way for innovative solutions to foster financial inclusion and drive meaningful change in the digital economy landscape.

Stand a chance to WIN with The Sandton Times.

Advertise on The Sandton Times today!

Head back to The Sandton Times Home Page for more stories.

![sandtontimes-discovery-bank-hylton-kallner-[2000×1125] SpendTrend24](https://sandtontimes.co.za/wp-content/uploads/2024/04/sandtontimes-discovery-bank-hylton-kallner-2000x1125-1.jpg)